As a chemical engineer there are situations, where we need to evaluate various investment options for purchasing a machine or going for a new plant project. So, to select the best option among available alternatives we use project investment appraisal methods or techniques. There are many Investment appraisal techniques like payback period, return on investment, net present value, accounting rate of return, and profitability index, etc. They are primarily meant to appraise the financial performance of a new project or a machine.

So, when we think about a new plant project or a new machine/equipment with latest technology, one immediate question arises in our mind. Which asks “Whether it is profitable or not? To get answer of this question, above mentioned techniques are very useful. Each technique evaluates the project from a different angle and provides a different insight. Let us understand these techniques in brief. This is a very important exercise we need to do at the initial phase of project management.

Table of Contents

Payback Period

The payback period of any project investment is the time which it takes to equalize the cost to the benefits/profits. In other words, we can say it is the time taken by a project to reach its break-even point. Whether a management will approve a project of not it is directly connected with payback period. If payback period for your project is shorter then it is more attractive investments. So, to estimate payback period for a project you can use below equation:

PBP = Total Project Cost/Net Profit from the Project

PBP or payback period we measure in months or year.

Net Present Value (NPV)

For an investment project, Net Present Value (NPV) is the future net cash flows from it. This is one of the popular ways to evaluate our investment. Therefore, it is a common term in the mind of any experienced business person. So, among the available options, the alternative which has highest NPV is the best option. The one difference between PBP and NPV is this, we measure PBP in terms of time (i.e., months or years), while NPV we calculate in terms of currency.

To estimate the net present value (NPV) for your project, you can use below relationship:

NPV = (Total Cash Flow) x (DCF) – Investment

In above equation there are two terms Total Cash Flow and DCF, let us understand them as below:

Total Cash Flow

You can estimate Total Cash Flow using below equation. In other words, this is the answer of a question, “How much cash you have in your hand?” at that point of time.

Total Cash Flow = Cash Inflow – Cash Outflow

For a business Cash Inflow should be greater than Cash Outflow, otherwise that cannot be a profitable business. So, cash inflow includes all the activities and avenues which bring money into the business, while cash outflow takes away money from the business. The examples for these two terms are as below:

Cash inflow to a business includes customer payments from sales, earning from investments, financing from bankers and shareholders, asset liquidation, etc.

Cash outflow from a business includes operating cost (i.e., Raw Material & Utility Cost), payments of suppliers & employees, payment of loan interest & taxes, new plant projects and acquisitions, debt payment, stokes buyback, insurance premium payment, etc.

Discount Factor (DCF)

DCF for a project is a decimal number, which you multiply by estimated future cash flow value to discount it back to its present value. This factor increases over time (meaning the decimal value gets smaller) as the effect of compounding the discount rate builds over time. You can estimate DCF using below equation:

Discount Factor (DCF) = 1 / (1 x (1 + Discount Rate) ^ Period Number)

Here, in this context of DCF analysis, the discount rate refers to the interest rate used to determine the present value. Otherwise, you can get this value from the finance department of your company.

Average Rate of Return (ARR)

The ARR, Average Rate of Return and Accounting Rate of Return are same terms. We can calculate the ARR by adding all the expected cash flows and dividing by the total number of years. In other words, Average Rate of Return (ARR) is the average cash flow generated over the life of a project investment. In ARR calculation we consider simple cash flow and do not use DCF or Discount Factor. So, to calculate ARR for a project investment you can use below formula:

ARR (Average Rate of Return) = (Total Cash Flow )/(no. of years of investment)

ARR = Average Annual Profit/Initial Investment

Here, Total Cash Flow = Cash Inflow – Cash Outflow

Average Annual Profit = Total Profit over Project Investment Life/Nos. of Years

Please note, ARR doesn’t take into account the time value of the money. As we know the worth of cash flows in future is lower than present worth.

Return on Investment (ROI)

We use ROI method to estimate the profitability of an investment project. You can estimate ROI using below relationship:

Return on Investment (ROI) = (Average Rate of Return)*100/Investment

For an investor, ROI is a simple financial matrix by using this he or she can decide whether to go for particular investment project or not. This clearly tells us the how your existing investment is performing till date. So, using an ROI formula, you can separate low-performing investments from high-performing investments. This way ROI enable us to optimize our investment portfolio to make best possible profit out of it.

Return On Capital Employed (ROEC)

This financial matrix is one of the best profitability ratio, which investors commonly use to get insight whether to investing in a running company is beneficial or not. This measures how efficiently a company is using its capital to generate profits. The formula for computing ROCE is as follows:

ROCE = EBIT/Capital Employed

Here, Capital Employed = Total Assets – Current Liabilities

EBIT (Earnings Before Interest and Taxes) = Net Income + Interest + Taxes

Or, EBIT = EBITDA – Depreciation and Amortization Expense

Current Liabilities are financial obligations of a business entity that are due and payable within a year.

Example to Understand Project Selection Methods

Let us consider below simple example where we have two investment options to go for putting a manufacturing plant. In Option-1 we can produce Chemical-A and in Option-2 we can produce Chemical-B. So, we will use above mentioned investment appraisal methods to find out the best alternative investment for our case.

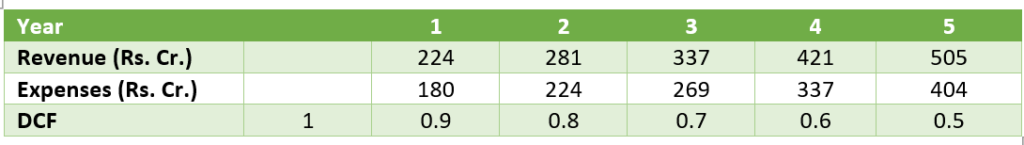

Option-1:

Investment required: Rs. 150 Cr.

Revenue (Cash Inflow) & Expenses (Cash Outflow) for 5 years are as in below able:

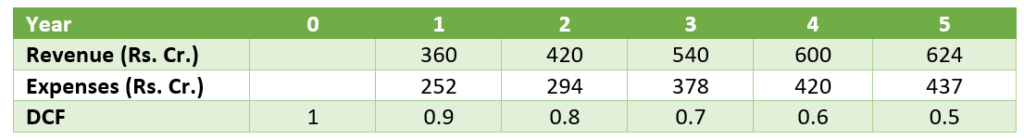

Option-2:

Investment required: Rs. 200 Cr.

Revenue (Cash Inflow) & Expenses (Cash Outflow) for 5 years are as in below able:

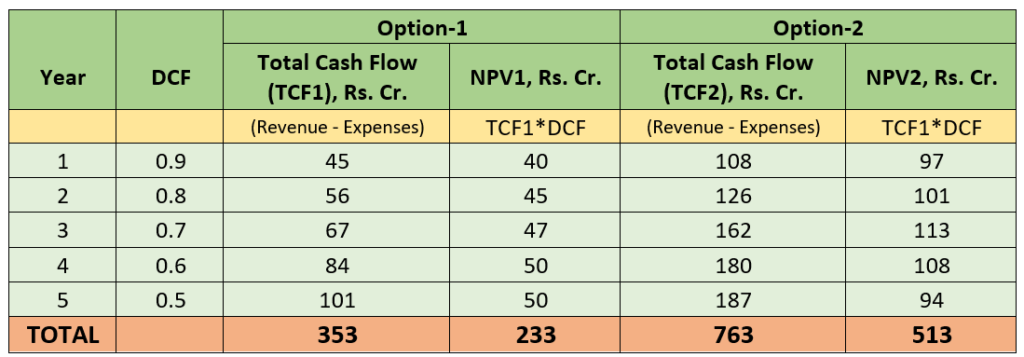

Investment Appraisal

Below are the various project investment appraisal methods for the selection of best option:

For Pay Back Period calculation,

Total Cash Outflow = Initial Investment + Total Expenses

And, Total Cash Inflow = Total Revenue

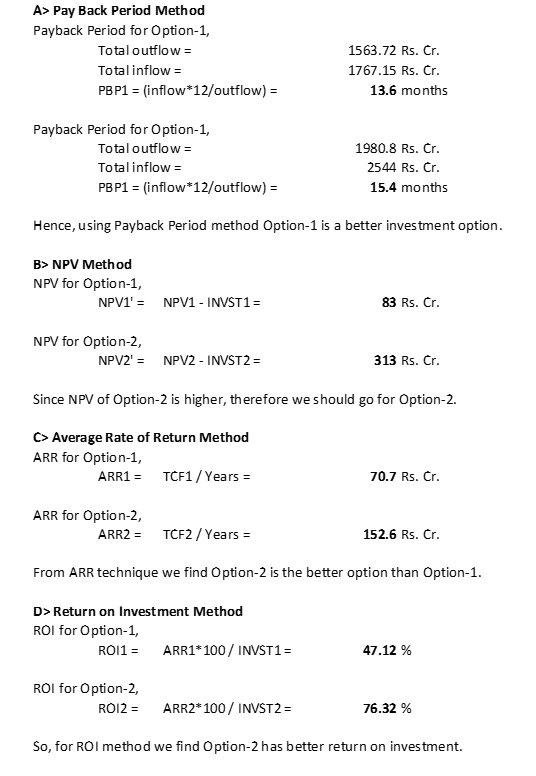

Conclusion

Finally, in this article we discussed various project selection methods. Also, we worked out an example to understand various investment appraisal techniques. In above example we found however using Pay Back Period Method Option-1 is preferable. But, remaining three methods, gave insight to go for Option-2. Moreover, we require these financial matrix to mention in our Project Charter also.

Also, we discussed about ROCE (return on capital employed), we use this financial matrix to evaluate a running business. Using this technique, we can get insight about running business financial health, moreover can take appropriate investment decision.

I hope this article will help you to do quick calculation for selecting your best investment option among various available alternatives.

Thank you..